Share

0

/5

(

0

)

In the contemporary reality of financial services, terms like Electronic Money Institutions (EMIs) and Payment Service Providers (PSPs) play crucial roles. Understanding the differences between these entities is essential for businesses entering the payment industry.

This comprehensive guide will explore the nuances of EMIs and PSPs, shedding light on their functionalities, licensing, and significance in modern banking.

Key Takeaways

EMIs are authorised entities that issue digital currency, complying with Electronic Money Directive 2.

PSPs act as intermediaries in electronic transactions, connecting parties involved securely and efficiently.

EMIs primarily issue e-money with specific licensing requirements, while PSPs offer a broader range of payment services, facing diverse regulatory challenges across jurisdictions.

Defining Electronic Money Institutions (EMIs)

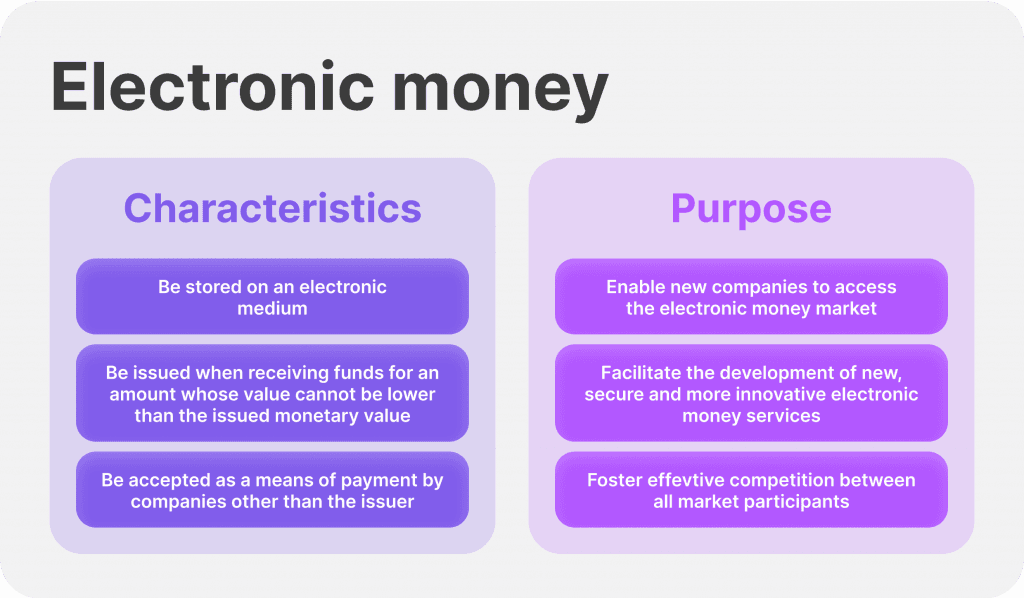

An Electronic Money Institution is an entity authorised to issue electronic money, complying with the directives outlined in the Electronic Money Directive 2. E-money refers to the digitally stored value representing a monetary value, which can be used for making payments, transferring funds, or storing value.

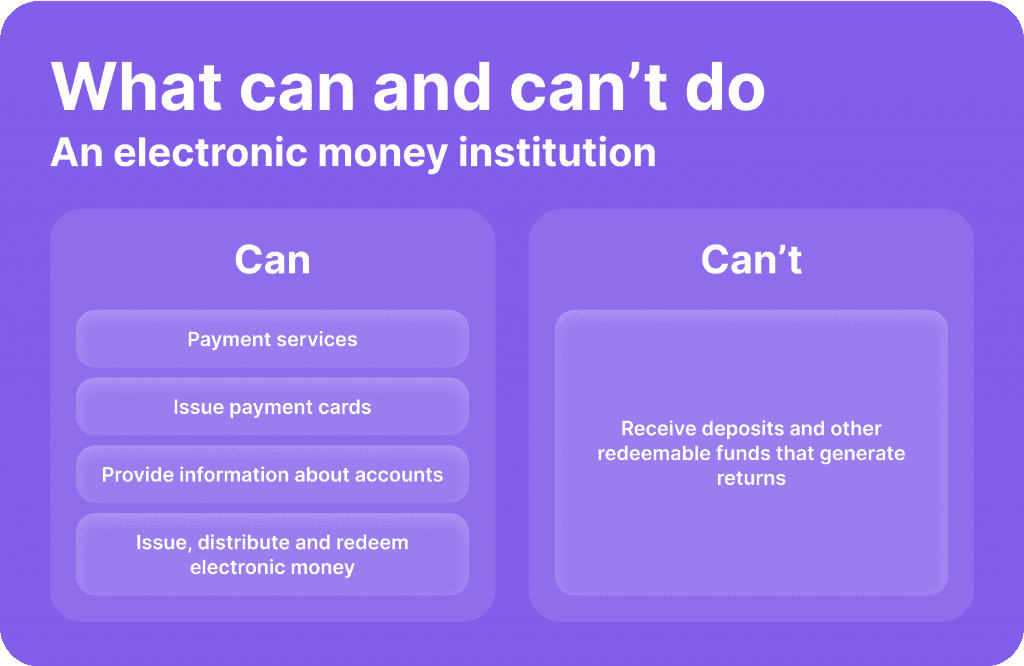

EMIs hold the authority to issue e-money, which users can access digitally, akin to traditional currency. Additionally, EMIs can provide payment services under the Payment Services Directive 2 (PSD2), enhancing their versatility in the financial landscape.

Key Features and Functions of EMIs

E-Money Issuance: EMIs have the authority to create e-money and issue it to users in exchange for funds. Electronic money issued by EMIs is stored electronically, typically in digital wallets or prepaid bank accounts. Users can access their e-money through various means, including prepaid cards, mobile apps, or online accounts.

Provide Payment Services: Besides issuing electronic money, EMIs offer various payment services to facilitate transactions. These services may include peer-to-peer transfers, online purchases, bill payments, and remittances. EMIs often integrate with other payment systems and networks to enable seamless fund transfers and transactions.

[aa quote-global]

Fast Fact

In 1983, a research paper titled "Blind Signatures for Untraceable Payments" by David Chaum introduced the idea of digital cash. In 1989, he founded DigiCash, an electronic cash company, in Amsterdam to commercialise the ideas in his research.

[/aa]

Understanding Payment Service Providers (PSPs)

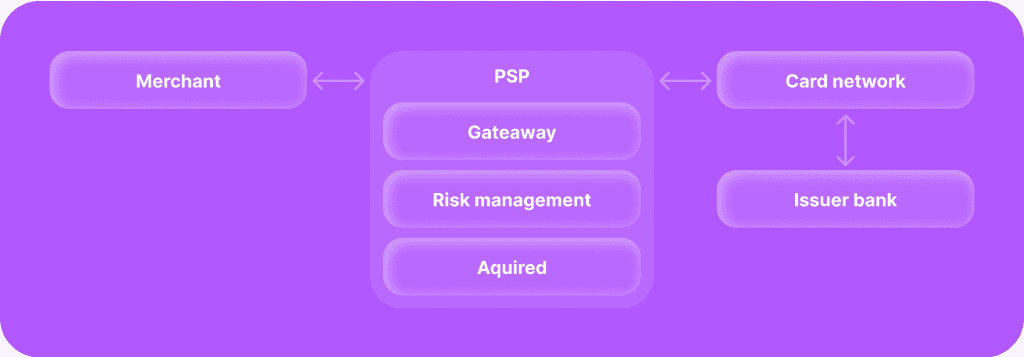

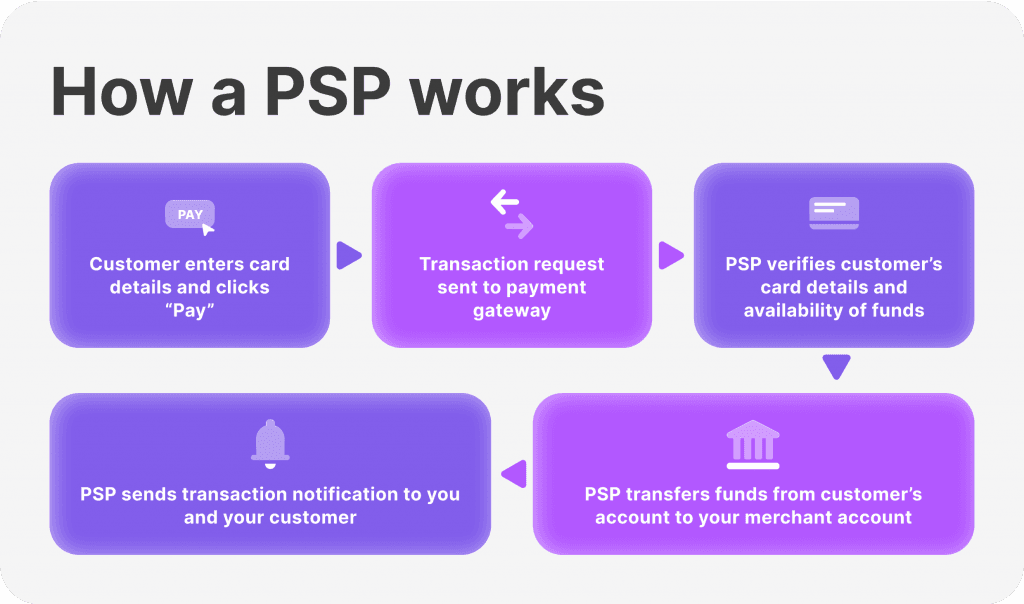

PSPs are entities that offer various services to facilitate electronic payments between individuals, businesses, and other organisations. PSPs act as intermediaries in the payment process, connecting multiple parties involved in a transaction and enabling the transfer of funds securely and efficiently.

They play a crucial role in the modern financial ecosystem by providing a wide range of payment solutions tailored to the needs of merchants, consumers, and other stakeholders.

While PSPs offer merchant accounts and payment gateways to facilitate transactions, they do not possess the authority to issue e-money, which distinguishes them from EMIs.

A Variety of Services Offered By PSPs

Payment Processing: PSPs offer payment processing services that enable merchants to accept various forms of payment, including credit cards, debit cards, and alternative payment methods. They facilitate the authorisation, authentication, and settlement of transactions between merchants and acquiring banks, ensuring smooth and secure payment processing.

Money Transfers: PSPs provide money transfer services that allow individuals and businesses to send and receive funds domestically and internationally. These services may include bank transfers, mobile money transfers, peer-to-peer transfers, and remittances, offering convenient and cost-effective options for transferring money across borders.

Merchant Acquiring Services: PSPs provide merchant acquiring services to businesses that wish to accept card payments from customers. They provide merchants with the necessary infrastructure, technology, and support to process card transactions securely and efficiently, including point-of-sale terminals, payment gateways, and payment processing software.

Differentiating EMIs from PSPs

Understanding the legal and regulatory distinctions, business models, and technological innovations in the EMI and PSP sectors is crucial for stakeholders. Let's see the main differences between them:

Primary Activities and Revenue Streams

Operational disparities between EMIs and PSPs extend to bank account functionalities and transaction handling. EMIs provide users with e-money accounts, allowing them to store funds digitally and execute transactions seamlessly.

In contrast, PSPs primarily focus on facilitating payment transactions, lacking the capability to hold funds on behalf of users for extended periods, as mandated by regulatory constraints.

EMIs primarily focus on issuing electronic money and providing related payment services such as prepaid cards, digital wallets, and online payments. Their revenue streams often stem from fees charged for issuing e-money, transaction fees, and interest on funds held.

PSPs offer a broader range of payment services, including payment processing, money transfers, and merchant acquiring. Their revenue streams may include transaction processing fees, interchange fees, and subscription or service fees charged to merchants or users.

Target Customer Segments and Market Positioning

EMIs typically target consumers and businesses seeking alternative digital payment solutions or looking to streamline their payment processes. They may cater to specific niches like online retailers, freelancers, or travellers.

PSPs serve a diverse range of customers, including merchants, financial institutions, governments, and consumers. They often position themselves as facilitators of seamless and secure payment experiences across various channels and industries.

Licensing and Authorisation Requirements

EMIs and PSPs adhere to distinct licensing requirements and regulatory frameworks. EMIs necessitate substantial initial capital, typically around EUR 350,000, along with rigorous licensing procedures, ensuring compliance with e-money issuance regulations.

Conversely, PSPs entail lower initial capital requirements, varying based on the scope of services offered, and primarily focus on facilitating payment transactions rather than issuing electronic money.

EMIs are typically authorised to issue e-money, which involves obtaining specific licences or authorisations from regulatory bodies. On the other hand, PSPs may provide payment services such as payment processing, money transfers, and merchant acquiring.

The licensing requirements for PSPs may vary depending on the services they offer and the jurisdiction in which they operate.

Supervisory Bodies Overseeing EMIs and PSPs

EMIs are usually supervised by regulatory authorities responsible for overseeing electronic money issuance and ensuring compliance with relevant regulations.

PSPs may be regulated by various bodies depending on the services they offer. For example, payment processors may be supervised by central banks, financial regulators, or specific payment system regulators.

Technological Infrastructure and Innovation

Both EMIs and PSPs rely heavily on technology to deliver their services efficiently and securely. They use digital platforms, payment gateways, APIs, and encryption technologies to process transactions, manage bank accounts, and ensure compliance with regulatory requirements.

EMIs often focus on developing user-friendly digital interfaces, integrating with mobile apps and online platforms to provide convenient access to electronic money services.

PSPs invest in advanced payment processing systems, fraud detection tools, and data analytics capabilities to optimise transaction flows, mitigate risks, and enhance customer experiences.

Emerging technologies such as blockchain, artificial intelligence, and biometrics drive innovation in EMIs and PSP sectors.

Blockchain-based digital currencies and decentralised payment networks offer new opportunities for EMIs to enhance security, reduce transaction costs, and expand their service offerings.

AI-powered fraud detection and risk management solutions enable PSPs to combat financial crime more effectively, while biometric authentication methods enhance security and convenience for users.

Challenges and Opportunities

EMIs and PSPs operate in a highly regulated environment with diverse regulatory requirements across jurisdictions. Navigating and complying with these regulations can be challenging and resource-intensive.

The main regulatory challenges faced by EMIs and PSPs are:

AML/KYC Compliance

Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is a significant challenge for EMIs and PSPs. Implementing robust AML/KYC procedures while ensuring a smooth user experience can be difficult.

Licensing and Authorisation

Obtaining the necessary licences or authorisations to operate as an EMI or PSP can be time-consuming and costly. Regulatory barriers may hinder market entry and expansion.

Data Protection and Privacy

EMIs and PSPs handle sensitive customer data, making data protection and privacy compliance crucial. Ensuring compliance with data protection regulations such as GDPR adds complexity to their operations.

Despite these challenges, there are a lot of opportunities for growth and expansion. The increasing adoption of digital payments and the rise of e-commerce present significant growth opportunities for EMIs and PSPs. Expanding into new markets or verticals can drive business growth.

Furthermore, forming strategic partnerships with fintech startups, banks, and other financial institutions can enable EMIs and PSPs to leverage complementary capabilities and expand their service offerings.

Outstanding emerging trends shaping the future of EMIs and PSPs are:

Open Banking and APIs: Open banking initiatives and the use of application programming interfaces (APIs) are reshaping the financial ecosystem, enabling EMIs and PSPs to access customer data and develop innovative financial products and services.

Digital Currencies and CBDCs: The growing interest in digital currencies, including central bank digital currencies (CBDCs), presents both opportunities and challenges for EMIs and PSPs. Integrating digital currency services into their offerings can attract new customers and drive innovation.

Conclusion

To sum up, EMIs and PSPs play pivotal roles in facilitating seamless transactions and driving financial innovation. Understanding the nuances between EMIs and PSPs is imperative for businesses willing to overcome the complexities of the payment industry.

By comprehending the distinctions outlined in this guide, businesses can chart a strategic course tailored to their specific needs for enhancing their financial operations and customer experiences.

Read also